Introduction

ATX tax software is an effective solution that helps firms and professionals prepare taxes more quickly. The main characteristics, advantages, and factors of utilizing ATX tax software are covered in detail in this article.

Tax season can be unpleasant for individuals as well as businesses. It’s simple to feel overburdened by the amount of paperwork, shifting tax laws, and intricate regulations. Having the appropriate tools at your disposal, though, may make tax management a lot easier. ATX Tax Software is useful in this situation. ATX provides all-inclusive solutions that are intended to optimize productivity, guarantee compliance, and simplify tax preparation. We’ll go over the features, advantages, and ways that ATX Tax Software can make your tax season easier in this post.

What is ATX Tax Software?

Wolters Kluwer Tax & Accounting created ATX Tax Software, a feature-rich tax prep tool. It is intended to help accountants, tax experts, and companies efficiently prepare and file a variety of tax forms. In order to improve accuracy, expedite the tax preparation process, and guarantee compliance with constantly evolving tax rules and regulations, ATX provides a variety of features and solutions.

Efficiency and Accuracy:

Improving tax preparation efficiency and accuracy is one of the main benefits of utilizing ATX Tax Software. Errors are minimized and human data entry is reduced thanks to the software’s automation features and straightforward features. ATX guarantees that your tax returns are correct and in compliance with current requirements through integrated error-checking procedures and real-time calculations. This reduces the possibility of costly errors that could result in audits or penalties in addition to saving time.

Comprehensive Solution:

ATX Tax Software provides an extensive toolkit to meet different tax requirements. ATX offers solutions for individuals, small business owners, and tax professionals handling numerous clients. A large variety of tax forms, schedules, and filings are supported by the software, including corporate, partnership, and individual income tax forms. Because of its adaptability, ATX is a great option for tax preparers who deal with a wide range of clients.

Benefits of ATX Tax Software

- Efficiency: By streamlining tax preparation operations, ATX software minimizes errors and saves time.

- Security: Sensitive taxpayer data is protected by sophisticated security mechanisms like data encryption and multi-factor authentication.

- Flexibility: Tax data may be safely accessed and managed from any location with the help of cloud hosting alternatives.

- Cost-Effectiveness: By only paying for the resources they utilize, cloud hosting removes the need for costly hardware purchases.

Cloud Hosting for ATX Tax Software

- Cloud hosting benefits ATX tax software users in a number of ways:

- Data Security: To safeguard sensitive tax data, cloud providers use strong security measures.

- Business Continuity: In the event of a disruption, disaster recovery plans guarantee data integrity and ongoing operations.

- Document Control: Secure file sharing and version control are made possible by real-time collaborative features.

- Competitive advantage: Small businesses may compete on an even playing field with larger rivals because of cloud-hosted ATX software.

Considerations for Using ATX Tax Software

- Training: Use online classes and webinars as well as other training tools to become acquainted with the software.

- Compliance: To guarantee adherence to best practices, and stay current on IRS regulatory standards.

- Integration: Configure products that are integrated to improve ATX software functionality.

- Support: For help and updates, make use of tools like the ATX Learning Portal and MyATX Solution Center.

What are the Features of ATX Tax Software?

A variety of features are available in the ATX tax software to meet the requirements of businesses, CPAs, and tax experts. Using the sources given, the following are some of the main characteristics of ATX tax software:

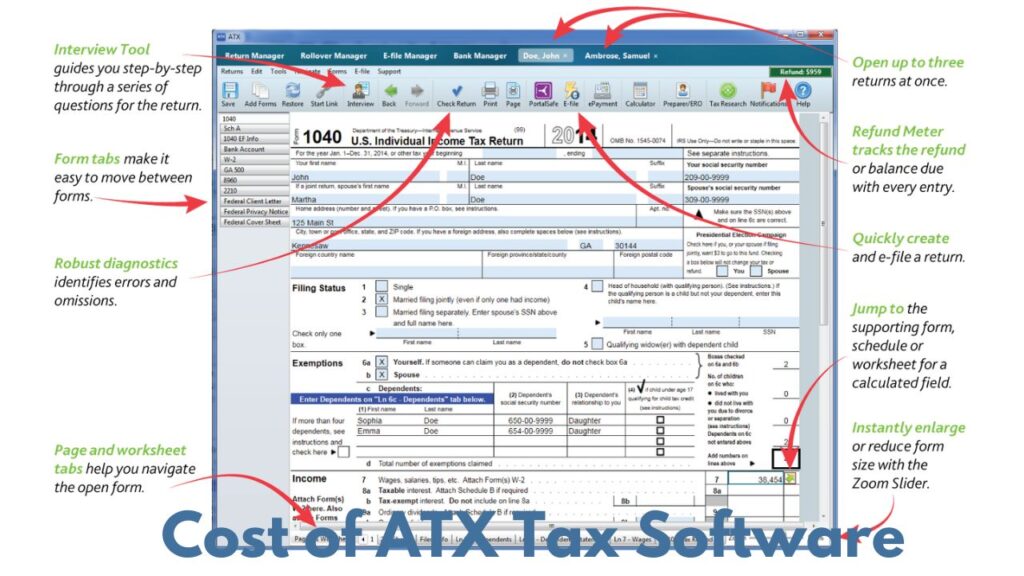

- User Interface: ATX offers a simple-to-use interface that makes it possible for users to interact with many forms at once.

- Tax Compliance Form Library: To make tax filing easier for preparers, the software comes with a large collection of federal, state, and local tax forms.

- Interview Tool: ATX offers a cutting-edge interview tool that interacts with preparers to walk them through the tax return process while automatically transferring data to the real tax return form.

- Tax Organizer: This application improves organization and speed in tax preparation by allowing preparers to add more information to open tax returns.

- Return E-Filing: ATX offers full support for electronic filing via the E-File Manager, which arranges and monitors the status of all electronically submitted returns and highlights mistakes and omissions.

- Refund Meter: One of the software’s features, Refund Meter assists users in tracking and estimating client refunds.

- Errors and Omissions Checkers: To guarantee a high degree of accuracy in tax preparation, ATX includes capabilities to automatically verify input data for errors and omissions.

- Integration with QuickBooks Online: For smooth data management, users can import Schedule C costs from QuickBooks Online into ATX with ease.

- Document Management: Using electronic document handling, ATX provides document management solutions to handle client documents, expedite processes, and use less paper.

- Seamless Integration: The program offers a complete practice management solution by integrating with other CCH programs, such as CCH iFirm, to provide access to client data, jobs, billing, and tasks.

Together, these characteristics give ATX tax software a comprehensive tool for tax professionals, facilitating tax preparation procedures with efficiency, accuracy, and user-friendliness.

What is the Cost of ATX Tax Software?

Depending on the bundle chosen, ATX tax software has different prices. The following lists the costs for various ATX tax software packages:

Package for ATX Pay-Per-Return:

- Cost: $799 with a $300 return deposit included.

- ATX 1040 Bundle: Cost: $1,059

- ATX MAX Package: $2,419 in price

- ATX Complete Tax Office Bundle: $3,589

These costs represent the price of several ATX tax software programs that meet the demands of different professions, small businesses, and organizations with diverse tax regulations.

Conclusion

In conclusion, tax professionals looking for security, flexibility, and speed in their tax preparation procedures can find a complete solution with ATX tax software. In a market that is highly competitive, customers can increase their productivity and provide precise results by utilizing its capabilities and cloud hosting alternatives.

An overview of the main features of ATX tax software is given in this article, along with information on its merits, the benefits of cloud hosting, and important factors to take into account for best use.

FAQs

Is ATX a good tax software?

Tax professionals may easily navigate through the capabilities of ATX software and prepare tax returns with ease thanks to its user-friendly design. It also provides editable templates that help prepare tax returns faster and with less effort.

How do I download ATX tax software?

Open your web browser and type https://support.atxinc.com/ to access the ATX Solution Center. 2. Select Year, then 2023, and finally Tax Program by clicking the Downloads button or the Downloads option. Enter your Client ID, User Name, and Password if you aren’t already logged in, then click Login.

How to install ATX software?

- Go to the page where you can download it. If you’re not signed in, go here.

- Click the downloaded file twice.

- To install ATX, follow the instructions.

- Examine the Release Notes. Following the initial installation and each application update, they will open automatically.

Is ATX cloud-based?

Sensitive tax information about your clients is shielded from unwanted access by industry-standard encryption algorithms used for all data kept on our cloud platform, both in transit and at rest.