Introduction

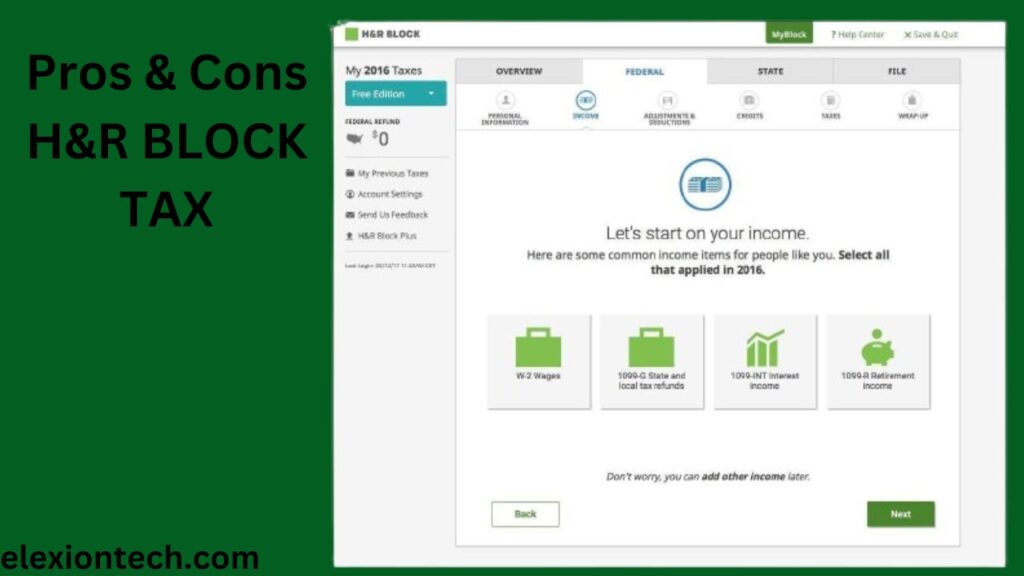

H&R Block tax software highlights its lengthy history, which dates back to 1955, and its vast experience in assisting customers in submitting forms, making it a well-liked and reasonably priced option for filing taxes.

For both individuals and corporations, tax season is frequently a stressful time. Compiling financial records, navigating complicated tax rules, and guaranteeing computation correctness can be difficult chores. But because to technological advancements, filing taxes is now easier and more convenient than ever. The H&R Block Tax Software is one such product that makes filing taxes easier for both individuals and small businesses. Let’s explore this user-friendly software’s features and advantages.

What is H&R Tax Software?

A computerized program called H&R Block Tax Software helps people and small businesses prepare and electronically file their taxes. The software, which was created by well-known tax preparation firm H&R Block, offers users a user-friendly design along with a number of features that make filing taxes easier.

User-Friendly Interface:

The H&R Block Tax Software’s user-friendly interface is one of its best qualities. The software’s user-friendly interface makes it simple to navigate through the many areas, regardless of experience level. Every step is explained in detail, from entering personal data to entering income and deductions, guaranteeing a simple and easy filing process.

Step-by-step Instructions:

Filing taxes can be confusing, particularly if you’re not sure which forms to use or what details to provide. This process is made simpler by H&R Block Tax Software’s guided, step-by-step methodology. To make sure they don’t overlook any crucial information, users are asked questions pertinent to their tax status. This guided procedure reduces errors and maximizes credits and deductions, which eventually results in a more accurate tax return.

Comprehensive Coverage:

H&R Block Tax Software addresses a broad spectrum of tax scenarios, regardless of your status as a small business owner, freelancer, or salaried employee. It accommodates a range of schedules and forms, including self-employment, rental properties, investments, and wage income. The software also includes credits and deductions for things like mortgage interest, medical costs, school fees, and more. Users may submit their taxes with confidence knowing they’re taking advantage of all applicable tax savings when they have complete coverage.

Importing Capabilities:

The days of manually inputting all of your financial data into tax forms are long gone. Users of H&R Block Tax Software can easily import their W-2, 1099, and other financial papers straight into the program thanks to its importing capabilities. Not only does this save time, but it also lowers the possibility of transcription errors. Streamlining the data entry procedure allows customers to concentrate on checking the quality and completeness of their tax returns.

What are the Features of H&R Block Tax Software?

H&R Block tax software has the following features:

- User-Friendly Interface: For users of all skill levels, the software provides an easy-to-use interface that makes tax filing simpler.

- Step-by-Step Guided Process: With clear prompts and instructions, users are led through every stage of the tax filing process, making sure that no crucial information is overlooked.

- Comprehensive Coverage: H&R Block Tax Software accommodates a wide range of tax scenarios, including revenue from several sources like investments, wages, rental properties, and self-employment. It also discusses credits and deductions to optimize possible tax savings.

- Importing Capabilities: Users can save time and lower the risk of error by immediately importing their W-2, 1099, and other financial papers into the software.

- Help in Real-Time: During the filing process, users can get real-time assistance from the program through FAQs, live chat support, video tutorials, and help articles.

- Security procedures: To safeguard users’ financial and personal information and provide a safe filing experience, H&R Block Tax Software uses industry-standard security procedures.

- Accuracy Guarantee: Users may file their taxes with confidence, knowing that their returns are accurate and in compliance with tax laws, thanks to the integrated error checks and accuracy guarantees.

- Audit Support: H&R Block Tax Software offers guidance and support to users during an audit, enabling them to effectively navigate the process.

- Mobile Accessibility: H&R Block Tax Software is accessible and able to be filed by users on a variety of devices, such as tablets, smartphones, and desktop computers. This provides users with flexibility and convenience.

- Updates and Upgrades: To ensure that customers have access to the newest features and advantages, the program is routinely updated to reflect changes in tax laws and regulations.

All things considered, H&R Block Tax Software provides a full range of functionalities that are intended to simplify the tax filing procedure and give users a hassle-free experience.

What is the Cost of H&R Block Tax Software?

Depending on the version chosen, H&R Block tax software has different prices:

- Basic: $25 to $35

- Deluxe + State: Between $49 and $59

- Cost of premium: $75–$85

- . Business & Premium: $89 to $99

- State e-file is offered for $19.95, while personal state programs cost $39.95 each.

- H&R Block Tax Software Deluxe Plus State 2023: Retailing for $49.99, this software may be downloaded for $39.97.

- H&R Block Tax Software Premium 2023: Retailing for $74.99, it may be downloaded for $59.99.

- H&R Block Tax Software Deluxe 2023: Retailing for $39.99, it may be downloaded for $29.97.

- H&R Block Tax Software Premium & Business 2023: Retailing for $89.99, this software can be downloaded for $69.99.

- H&R Block Tax Software Basic 2023: Costs $24.99 to download.

- H&R Block Premium Tax Software 2023 (Mail-order Physical Code): $59.99, plus free shipping and a list price of $74.99

The breadth of options offered for various H&R Block tax software versions, meeting varied tax demands and preferences, is reflected in this pricing.

Pros and cons of H&R Tax Block Software?

Pros:

- User-Friendly Interface: Users may easily navigate through the tax filing procedure thanks to the software’s intuitive interface.

- Step-by-Step Guidance: H&R Block Tax Software takes customers step-by-step through the tax filing process, making sure they don’t overlook any crucial details.

- Extensive Coverage: To optimize possible tax savings, the software offers a wide range of tax scenarios, including income from many sources, credits, and deductions.

- Importing Features: By allowing users to import their financial documents straight into the program, errors are less likely to occur and time is saved.

- Real-Time Support: H&R Block Tax Software gives users access to FAQs, live chat support, video lessons, and help articles, providing support anytime they need it.

- Security methods: To safeguard users’ financial and personal information, the software uses industry-standard security methods.

Cons:

- Cost: Although H&R Block Tax Software has multiple pricing tiers to suit different tax scenarios, some customers could find the software to be more expensive than alternative tax filing solutions.

- Internet Connection Needed: In order to use several functions of the software, users usually need to have an internet connection. This could be a problem for users who live in places with inadequate internet access.

- Learning Curve: Despite the software’s user-friendly design, new users may nevertheless encounter a learning curve as they get used to the capabilities and interface.

- Limited Customer Support Hours: Although live chat support is offered, its availability may be restricted, which may cause issues for users who need assistance after usual business hours or who are in other time zones.

Conclusion

Thanks to H&R Block Tax Software, filing taxes doesn’t have to be a difficult undertaking any longer. For both individuals and small enterprises, the program makes tax filing easier with its user-friendly interface, guided step-by-step approach, extensive coverage, importing capabilities, real-time support, and emphasis on security and accuracy. With H&R Block Tax Software, bid tax season stress farewell and hello to a hassle-free filing experience.

FAQs

What is the most popular software used for filing taxes?

Because of its user-friendly layout, TurboTax is the finest online tax software for the majority of taxpayers.

Does H&R Block get you the most money back?

We support you whether you would rather file on your own using our online tools or with the assistance of a tax expert. We therefore promise to reimburse your maximum taxes and more. You’ll always be aware of the cost of your tax preparation thanks to our No Surprise Promise.

Can I install H&R Block software on multiple computers?

Installing the H&R Block Tax Software from the original installation CD on the new computer is necessary if you wish to move H&R Block to it.