Introduction

For tax firms serving both commercial and individual clients, Lacerte Tax Software is ideal. This product is intuitive. With its integrated tools and fast speed through even the hardest returns, Lacerte offers speed. A flat worksheet-based design for quick, heads-down data entry and direct access to request forms are just two examples of the unique interface’s many clicks and time-saving features.

For both people and tax professionals, tax season can be a scary time. It’s essential to have dependable software that can expedite and guarantee accuracy of the tax preparation process because tax laws and regulations are always changing. Enter Lacerte Tax Software, a potent instrument made to reduce errors, increase efficiency, and simplify tax preparation. This post will discuss the attributes and advantages of Lacerte Tax Software and how it may completely change the way you handle taxes.

What is Lacerte Tax?

With 5,700+ tax forms to cover every possible tax situation and a potent tax engine, Intuit Lacerte Tax provides a special set of tools. Its more than 25,000 sophisticated tests are always looking for problems. Even the most complicated returns and numerous preparers may be easily managed with Lacerte’s user-friendly interface and robust reporting features. Additionally, Lacerte can be connected to integrated services like cloud hosting and practice management solutions that are intended to increase your efficiency.

Lacerte Tax Software Cost

The main target market for Lacerte Tax Software as of my most recent update in January 2022 is accounting companies and professional tax preparers. The number of users or licenses necessary, the precise features and capabilities required, and any extra services or support choices chosen can all affect the price of Lacerte Tax Software. This is a broad summary of Lacerte Tax Software’s price structure:

Base Software Package

Forms and schedules for individual and business tax returns are among the basic aspects of most tax preparation software packages. The fundamental software package can cost anywhere from a few hundred to several thousand dollars per user/license, depending on the version and any applicable discounts or special offers.

Add-On Modules

For certain tax cases or extra functionality, Lacerte Tax Software provides add-on modules. Features for complicated tax scenarios, like multi-state tax preparation, partnerships, corporations, trusts, and more, might be included in these modules. Usually charged individually, the cost of add-on modules varies according on the particular module and the quantity of users/licenses.

E-filing and Compliance Services

Depending on the amount of electronically filed tax returns and any optional services chosen, including electronic signature capabilities or electronic payment processing, e-filing services and compliance features may come at an additional fee. These expenses could be included in a subscription package or assessed on a per-return basis.

Training and Support

These services could be included in a packaged package or offered as extra add-ons. Examples of these services include technical support, onboarding help, and access to training materials. Depending on the level of support needed and any recurring subscription fees connected to accessing support resources, the price of training and support services can change.

It’s crucial to remember that Lacerte Tax Software pricing is subject to change. Additionally, based on unique circumstances or collaborations with professional associations, there can be exclusive offers, reductions, or bespoke pricing choices available. Furthermore, geographical location and other variables may affect price.

It is advised that you get in touch with Intuit, the company that creates and distributes Lacerte Tax Software, or visit their official website for the most accurate and up-to-date information on pricing and licensing options. You can also request a quote based on your unique requirements and detailed pricing information.

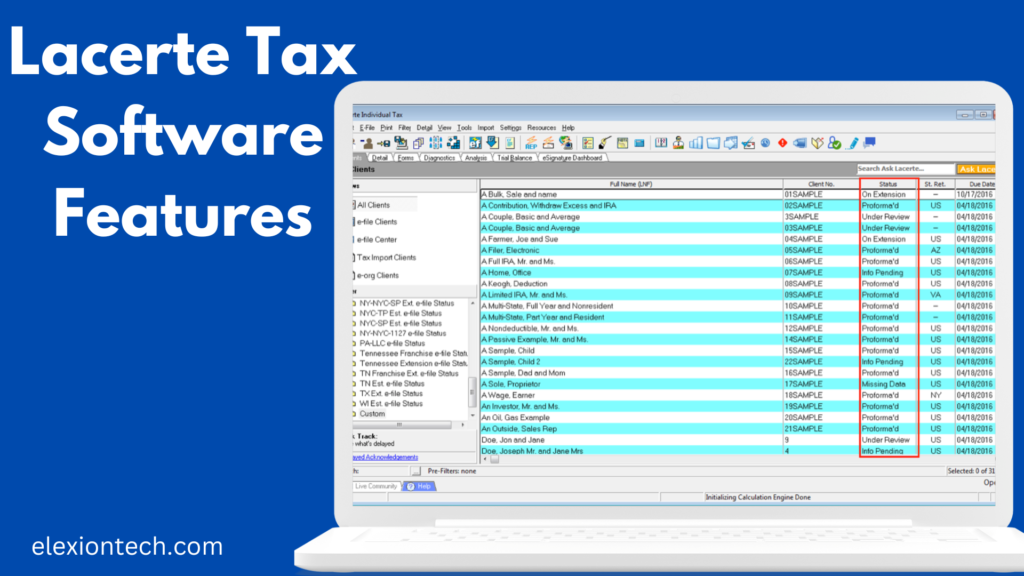

Lacerte Tax Software Features

More Options and Exciting Features for E-Filing Plus Payments with eSignatures eSignature is a product of Intuit and DocuSign’s partnership.

With eSignature incorporated into the Lacerte Tax Software, securely sign Form 8879 in the IRS-approved manner. It also has a money collection capability that allows billing requests to be processed concurrently with customer payments. eSignature streamlines the billing process and saves time.

Lacerte Tax Software Expanded E-File

E-file available year-round for Lacerte Fast Path services for all open years.

There aren’t any additional e-file costs.

You value a complete tax solution greatly, which is why we continue to place a high premium on developing new tax forms and expanding e-file support.

Together with more than 50 new e-file return types—including individual, partnership, corporate, s-corporation, and fiduciary—for more than 15 states, you will be able to electronically file federal modified fiduciary returns.

Lacerte Tax Software Fast, Reliable E-Filing

The latest and enhanced e-filing allows you to transmit returns much faster.

Integrated, built-in e-filing for supported company and individual form sets

Sending returns quickly is made easy by the streamlined e-file wizard, especially when checking and correcting validation mistakes.

Possibility of transmission verification via an online Lacerte account

A successful e-file experience is guaranteed by Lacerte’s e-file Atlas, which offers a plethora of up-to-date Federal and State e-file information. Lacerte also assists you in staying informed about the IRS e-file mandate.

Lacerte Tax Software e-Organizer Features

Using bespoke emailed tax analysis software instead of paper ones will allow you to obtain the necessary information from each client more quickly, more affordably, and with less difficulty.Easy-to-use electronic checklists and surveys will simplify life for both your team and your clients.

Avoid wasting money and time on paper organizers that need to be printed, assembled, and shipped. Ensure security by using password-protected files that are only visible to your clients. Reduce data input errors by typing nothing at all when moving authorized values to the appropriate tax forms and lines in Lacerte Tax.

Distribute Hundreds of Organizers Instantly

An e-Organizer Wizard in the Lacerte Tax program facilitates the sending of forms, questionnaires, and email correspondence to clients. Everything they need is in the e-Organizer, which includes an introduction, usage guidelines, FAQs, the option to write questions for you to respond to, and the opportunity to download tax papers directly into the organizer.

Cloud Hosting for Lacerte Tax Software

Efficiency and accessibility are critical in the hectic field of tax preparation. Thanks to the development of cloud computing, tax professionals may now streamline their processes and increase efficiency. Lacerte Tax Software is one such program that gains a lot from cloud hosting. In this post, we’ll examine the benefits of cloud-based Lacerte Tax Software hosting and how it may revolutionize the practice of tax preparation.

Accessibility Anytime, Anywhere:

Tax professionals can use Lacerte Tax Software from any location with an internet connection thanks to cloud hosting. You may safely log onto the cloud platform and carry out your tax preparation activities whether you’re at home, in the workplace, or even on the go. This degree of accessibility encourages adaptability and makes it possible for team members to work together regardless of where they are physically located.

Scalability to Meet Demands:

The demand for tax preparation services peaks and troughs during tax season, which frequently causes workload changes. Scalability provided by cloud hosting makes it simple for tax professionals to increase or decrease their computer resources in accordance with their changing requirements. This implies that at peak periods, you may quickly scale back and add more users, storage, or processing power.

Strengthened Security Protocols:

Security is critical while handling sensitive financial data. Strong security procedures are put in place by cloud hosting companies to safeguard data kept in the cloud, frequently going above and beyond what individual businesses would do. Client data is kept secure and in compliance with industry requirements thanks to cloud hosting for Lacerte Tax Software, which employs encryption, multi-factor authentication, and frequent security assessments.

Automated Software Updates:

Keeping software current is critical to preserving productivity and adhering to the most recent tax laws. The hosting company handles Lacerte Tax Software upgrades automatically while using cloud hosting. As a result, tax professionals won’t need to bother about handling compatibility problems or manually installing updates.

Disaster Recovery and Business Continuity:

Whether it’s a hardware malfunction, a natural disaster, or a cyberattack, disasters can happen at any time. Built-in disaster recovery options are offered by cloud hosting, with backups and data replication kept in several geographically dispersed locations. Tax professionals can promptly restore their data and continue operations with minimal delay in the case of a disaster, guaranteeing clients’ peace of mind and business continuity.

Conclusion

In conclusion, there are numerous advantages to using cloud hosting for Lacerte Tax Software, such as increased security, scalability, accessibility, automated software updates, and disaster recovery capabilities. Tax professionals may increase cooperation, expedite productivity, and concentrate on providing outstanding customer service by utilizing the cloud.

It’s crucial to remember that Lacerte Tax Software pricing is subject to change. Additionally, based on unique circumstances or collaborations with professional associations, there can be exclusive offers, reductions, or bespoke pricing choices available.

Furthermore, geographical location and other variables may affect price. It is advised that you get in touch with Intuit, the company that creates and distributes Lacerte Tax Software, or visit their official website for the most accurate and up-to-date information on pricing and licensing options.